However, you are not required to give up on buying things, all you need to do is re-evaluate your decisions and approaches. In other words, how to still get what you want, but at the same time preserve your budget. Prudence is a virtue, you should not hesitate to practice, for it will bring a certain dose of stability in your future life.

1. Bottled water

Yes, water is one of our essential needs, but we are not obliged to spend money on bottled water. Even though tap water usually contain harmful bacteria, it can be drinkable if you install a water filter. Truth be told, a filter is not that big of an investment, yet it can save a lot of money and it is far more convenient to pour water from the tap. A liter of bottled water approximately costs 2$, and let us assume that the natural daily intake of water is around 2,5 or 3 liters. By switching to tap water, you save up to $5 dollars on a daily basis, or $150 per month.

2. Printer ink cartridges

Regardless whether you use your printer frequently or not, buying a new cartridge every time your old one is depleted, is an unnecessary expense. Cartridges are designed to be refilled, and you can either have someone else to do it, or you can get your hands dirty and fill them yourself. Either way, you will restore its functionality at only half the price. Moreover, it would be wise to buy a quality printer that uses cheaper ink, if you tend to use your printer regularly. A new cartridge can cost between $40 and $60, but it can be even higher. Refilling, on the other hand, is only between $10 and $12, so you save around $30 by opting for a refill.

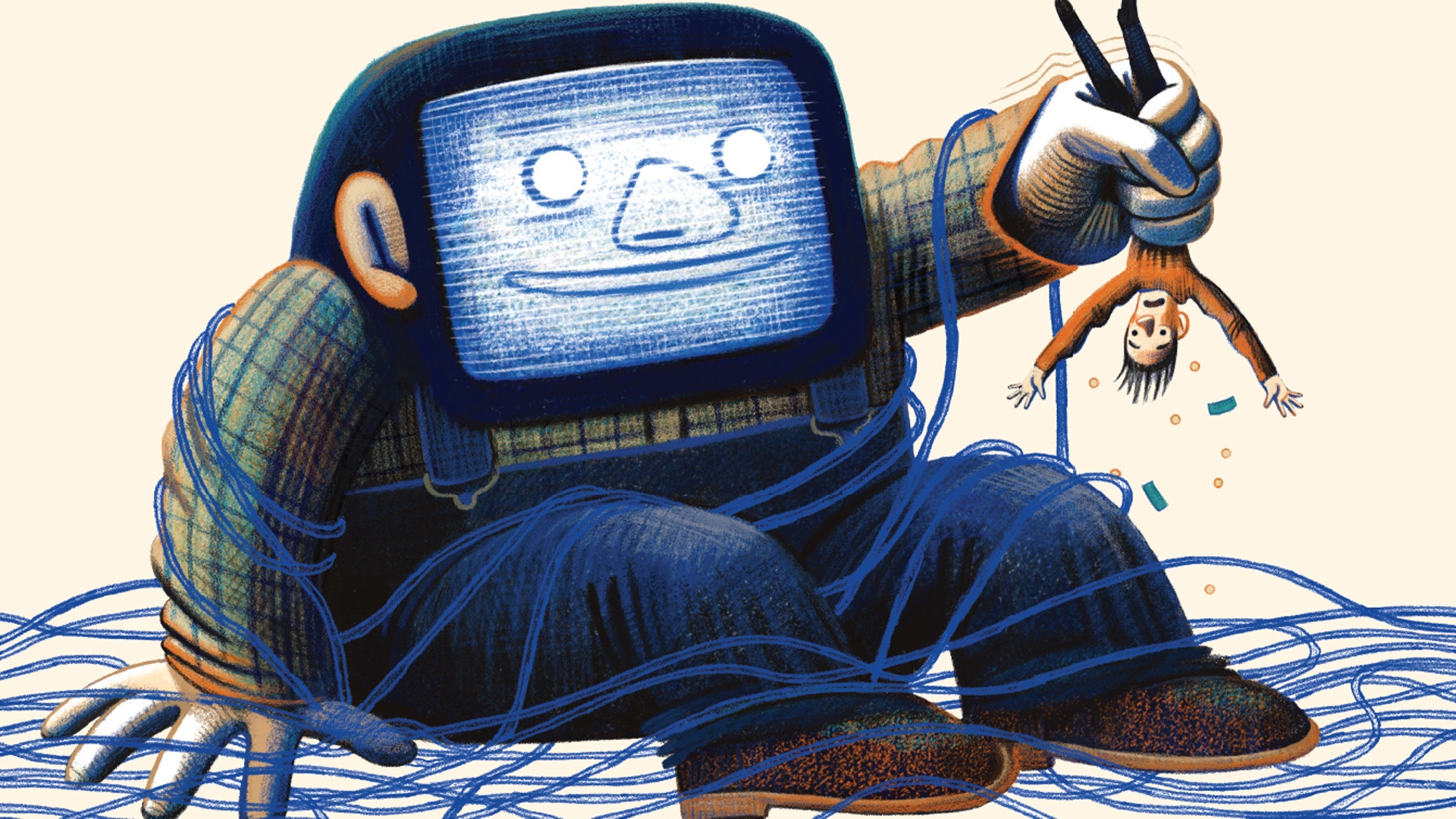

3. Cable TV and magazine subscriptions

Almost everything you want to read in your magazine is available online for free. As far as cable or satellite TV is concerned, you can stream an incredible number of shows or full length movies on Hulu.com, free of charge. Netflix offers a lot of quality material as well, charges only 9$ a month for these services, which is still cheaper than your cable subscriptions. In other words, any quality TV show you pay over $9, is basically a waste of money.

4. Books

It may sound outrageous, how can buying a book be considered as reckless spending. Well, it can. Buying books online, and reading it on an e-reader is a cheaper alternative, borrowing books is another budget friendly option, and a membership in the library is perhaps the best one. Buying a book that you want to read more than once is alright, but let’s face it, we love to show off. We decorate our bookshelves with our favourite chronicles and authors, to the point when it starts to feel shallow. The whole point of a book is to provide you with cautionary tales, help you forge some personal wisdom and moral values. If you start to treat it as a personal possession that you use to impress your friends, then you are buying it as a decoration. It is hard to say exactly how much you save by buying books for an e-reader, but you save around 40 to 50% for each book you purchase.

5. Expensive Branded items

Let’s be honest, in the event you have developed a taste for buying globally renowned branded items, then your wallet is in a serious trouble. There is nothing wrong with having your own style, or trying to mimic modern fashion, but paying significantly more, simply because of a particular trade mark is madness. For example, buying an expensive item can sometimes cause more stress than satisfaction. You are more likely to get mugged, so you need to be vigilant all the time; it may not be compatible with all of your dressing combinations. A luxurious bag can cost $1000 or even more, but a military messenger bag f.e. will cost between $70-$100. The same applies for other branded items, if they drain your budget, condition yourself to look for cheaper alternatives. Learn to be more creative, don’t try to impress people with brand names – you are spending too much for something that is only a fleeting sensation.

6. Video games

This is the same as with books – you do not need to own the game, you are only enlarging your connection to impress the Internet (the online community). It is alright to consider yourself a proud gamer, however, spending tons of cash just to let it the world know is absurd. Surely, you have friends who are also game enthusiasts – make an agreement with them, who will buy which upcoming game. There is no need to spend $40 every time a new game comes on the market. Furthermore, if you play games with monthly subscriptions ($10 – $15 a month), or even worse, freemium games, stop at once. Do not even try to justify the reason why you are playing them, just stop and find a new hobby. If you are able to play it for two or three months, see what it’s is all about and quit. If you can’t show this level of restraint, then you should aks yourself if you might be an addict.

7. Lottery tickets

The number of people who play the lottery is ridiculously high. As John Oliver on “Last Week Tonight” said: Planning how you will spend your lottery winnings is an equivalent to planning what to say on your third date with Beyoncé. The only thing your lottery ticket does, is help the rich to get richer. Despite the fact that a single lottery ticket is approximately $3, the amount of money people spend to participate is large, since you usually buy more than one ticket. Instead of buying a ticket, put all that money in a piggy bank, and you are bound to be more satisfied after a couple of months, when you smash it.

8. Buying new things

Buying a new cell phone, a new car, a new console etc. the moment it appears on the market is yet another form of irresponsible spending, especially if you already have properly functioning utilities that are former models. Boasting with new items can be fun, but continually doing so is just sad. Why would you work so hard, every day, only to allow yourself to be manipulated by cheap advertising tricks? If you think of yourself as a collector or enthusiast, there is no need to buy these items the moment they hit the shelves. If your old iphone is still functioning, you do not need to spend $600 just to buy a new model. The same applies to your car – spending between $6000-$7000 for a new one is losing a fortune for no particular reason.